Why can Glass Raw Material reach Highs in 2020 repeatedly?

In “three days a small rise, five days a big rise”, the price of glass hit a record high. This seemingly ordinary glass raw material has become one of the most erring businesses this year.

By the end of December 10th, glass futures were at their highest level since they went public in December 2012. The main glass futures were trading at 1991 RMB/ton, while compared with 1,161 RMB/ton in mid-April, 65% increase in these eight months.

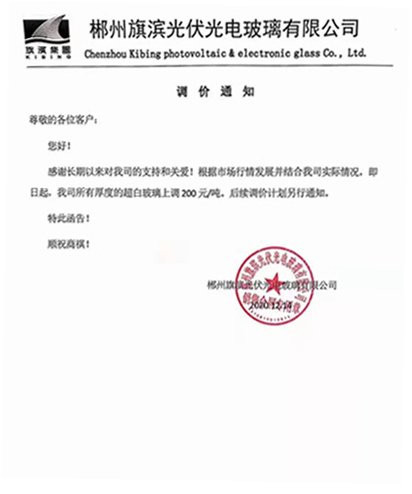

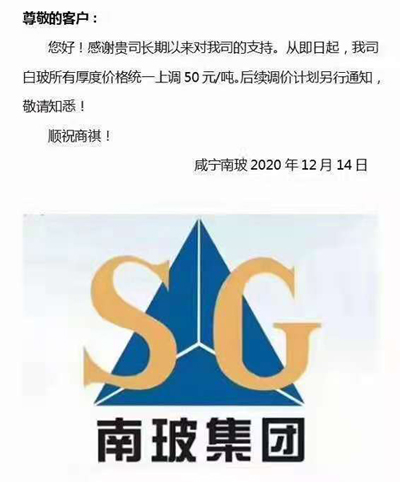

Due to the short supply, the spot price of glass has been raising rapidly since May, from 1500 RMB/ton to 1900 RMB/ton, a cumulative increase of more than 25%. After entering the fourth quarter, glass prices initially remained volatile around 1900 RMB/ton, and returned to the rally in early November. Data show that on December 8th the average price of float glass in major cities in China was 1,932.65 RMB/ton, the highest since mid-December 2010. It is reported that the cost of one ton glass raw material is around 1100 RMB or so, which means glass manufacturers have more than 800 yuan profit per each ton under such market environment.

According to market analysis, the end demand for glass is the main supporting factor for its price increase. At the beginning of this year, affected by COVID-19, the construction industry generally stopped work until March after the domestic epidemic was effectively prevented and controlled. As the delay in the project progress, the construction industry appeared to catch up with the tide of work, driving the strong demand in the glass market.

At the same time, the downstream market in the south continued to be good, small home appliances at home and abroad, 3C product orders remained stable, and some the glass secondary processing enterprises orders rose slightly month-on-month. In the downstream demand stimulus, East and South China manufacturers have raised spot prices continually.

Strong demand can also be seen from inventory data. Since mid-April, the stock glass raw material have been in a relatively fast sold out, the market continues to digest a large number of stocks accumulated as a result of the outbreak. According to Wind data, as of December 4, domestic enterprises float glass finished products inventory of only 27.75 million weight boxes, down 16% from the same period last month, a nearly seven-year low. Market participants expect the current downward trend to continue into the end of December, although the pace is likely to slow.

Under the strict control of production capacity, Analysts believe that float glass is expected next year in production capacity growth is very limited, while profits are still high, so the operating rate and capacity utilization rate is expected to be high. On the demand side, the real estate sector is expected to accelerate construction, completion and sales, the automotive industry maintains strong growth momentum, glass demand is expected to be boosted, and prices are still in a phase of upward momentum.